The insurance industry is undergoing rapid transformation. Legacy systems, manual processes, and document-heavy workflows are creating operational bottlenecks that impact everything from underwriting speed and fraud detection to claims settlement times.

Firemind’s production-ready AI for insurance delivers measurable transformation across underwriting, claims, and compliance. We help insurance organisations unlock the power of AI to automate complex workflows, accelerate decision-making, and reduce operational costs, all while maintaining regulatory compliance and risk management standards.

From operational friction to measurable results

Eliminate manual bottlenecks

Accelerate decision-making

Strengthen compliance and trust

Six Pillars of Excellence

Every phase is evaluated across these critical dimensions

-

Operational Excellence

Seamless integration with your workflows -

Performance

Real-time processing capabilities

-

Security

GDPR/CCPA compliance and data protection -

Cost Optimisation

ROI-focused implementation

-

Reliability

99.9% uptime and consistent results -

Sustainability

Energy-efficient infastructure

European expertise for compliant, production-ready AI transformation

Operational and regulatory pressures are facing insurers across Europe. Firemind combines deep expertise in regulated BFSI environments with AWS and NVIDIA partnerships to deliver production-tested AI solutions that meet GDPR, Solvency II, and audit requirements from day one.

Unlike providers who start with workshops and pilots, we help insurance companies move straight to measurable outcomes cutting costs, strengthening compliance, and accelerating operational excellence without the delays of proof-of concept cycles.

Built for insurance leaders driving change

Firemind delivers production-ready AI for insurance transformation accelerating decisions, cutting costs, and ensuring compliance from day one.

For COOs

For underwriting leaders

For claims leaders

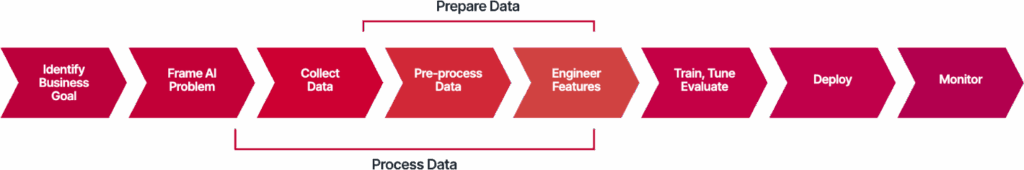

How we deliver AI solutions for insurance

We follow a well-architected machine learning framework, a proven methodology that ensures every AI project delivers measurable business value while maintaining security, reliability, and cost effciency.

1. Identify Business Goal

Define clear objectives and success metrics aligned with your strategic priorities.

Example: Reduce claims processing time by 70% while maintaining accuracy

2. Frame AI Problem

Translate business needs into technical solutions with measurable outcomes.

Determine the right AI approach: classification, prediction, or generation

3. Collect & Prepare Data

Aggregate historical data, clean inconsistencies, and engineer predictive features.

Consolidate claims history, policy documents, and customer interactions

4. Train, Tune & Evaluate

Build multiple model candidates and validate accuracy against real-world scenarios.

A/B testing with pilot groups to ensure reliability before full deployment

5. Deploy

Integrate seamlessly with existing systems through gradual, monitored rollout.

Connect to policy management, CRM, and claims platforms with minimal disruption

6. Monitor & Improve

Track model performance, detect drift, and continuously refine based on new data.

Real-time dashboards showing accuracy, processing speed, and business impact

AI opportunities

by department

of your organisation.

Underwriting

- Automated Risk Scoring & Triage

- Intelligent Document Analysis

- Dynamic Pricing Optimisation

- Underwriting Assistant & Guidelines Navigation

- Predictive Loss Forecasting

- Portfolio Analytics & Risk Concentration Monitoring

- Telematics & IoT Behavioural Risk Assessment

- Satellite & Aerial Imagery Risk Analysis

- Predictive Equipment & Infrastructure Failure Analysis

Claims

- Automated Claims Triage & Routing

- Intelligent Document Processing & Data Extraction

- Predictive Claims Analytics & Outcome Forecasting

- Fraud Detection & Anomaly Identification

- Virtual Claims Assistant & Customer Self-Service

- Automated Coverage Analysis & Decision Support

- Intelligent Settlement Negotiation Recommendations

- Computer Vision Damage Assessment

- Subrogation Opportunity Identification

Acturial

- Advanced Predictive Modelling & Risk Segmentation

- Automated Reserve Analysis & Development

- Real-Time Portfolio Analytics & Monitoring

- Intelligent Rate Filing Automation

- Catastrophe Scenario Analysis & Stress Testing

- Automated Actuarial Documentation & Knowledge Management

- Natural Language Analytics & Report Generation

- Climate-Adjusted Loss Projection Models

- Real-Time Dynamic Pricing Optimisation

Sales & Distribution

- Predictive Lead Scoring & Prioritisation

- Intelligent Quote Generation & Pricing Recommendations

- Conversational AI Sales Assistant

- Customer Propensity Modelling & Cross-Sell Identification

- Automated Distribution Partner Performance Analytics

- Dynamic Territory & Resource Optimisation

- Personalised Marketing Content Generation

- Competitive Win/Loss Analysis

- Social Media Intelligence & Digital Lead Mining

- Real-Time Competitive Pricing Intelligence

Customer Service

- AI-Powered Virtual Assistant & Chatbot

- Intelligent Call Routing & Workload Distribution

- Real-Time Agent Assistance & Knowledge Management

- Predictive Retention & Proactive Outreach

- Sentiment Analysis & Interaction Quality Monitoring

- Automated Policy Administration & Transaction Processing

- Multi-Language Support & Real-Time Translation

- Emotional Intelligence & Escalation Detection

- Voice Biometrics Authentication

Finance & Accounting

- Automated Transaction Processing & Coding

- Intelligent Reconciliation & Anomaly Detection

- Predictive Financial Forecasting

- Automated Financial Reporting & Disclosure Generation

- Cash Flow Forecasting & Working Capital Optimisation

- Real-Time Payment Fraud Detection

- ESG Reporting & Sustainability Analytics

Risk Management

- Predictive Risk Modelling

- Advanced Catastrophe Modelling

- Dynamic Risk Dashboards

- Portfolio Optimisation

- Cyber Risk Quantification & Modelling

- Climate Risk Analytics & Adaptation Planning

- Third-Party Risk Intelligence

Information Technology

- AI-Powered DevOps

- Intelligent Security Operations

- Infrastructure Optimisation

- Automated Code Quality

- Cloud Migration Intelligence

- Automated Incident Response & Resolution

Legal & Compliance

- Regulatory Intelligence

- Contract Intelligence

- Compliance Monitoring & Audit

- Legal Research Assistant

- AI-Powered Policy Language Drafting

- Regulatory Change Impact Assessment

Product Development

- AI-Powered Market Intelligence & Trend Analysis

- Automated Competitive Product Analysis

- Customer Needs Mining & Persona Generation

- Rapid Product Design & Feature Optimisation

- Regulatory Compliance Pre-Check

- Product Performance Prediction & Optimisation

- Dynamic Personalisation Engine

- Automated Product Documentation Generation

- Parametric Insurance Product Automation

Proven AI. Real results for insurance.

European insurers are already seeing the impact: processing times cut by up to 90%, claims handling costs reduced by 30%, and underwriting capacity tripled. Firemind’s governance-first AI solutions move you from pilots to production—fast, compliant, and value-driven.

Production-ready accelerators you can deploy today

Firemind doesn’t just identify challenges, we’ve built and deployed ready-made AI solutions that insurers can put into production immediately. These accelerators reduce risk, cut implementation time, and deliver measurable ROI from day one.

Underwriting automation

Claims processing automation

Fraud detection & risk control

Customer experience transformation

Deployed conversational AI, 24/7 assistants, and real-time support that improve customer satisfaction while lowering service costs.

Compliance & governance automation

Production-ready accelerators you can deploy today

Firemind doesn’t just identify challenges, we’ve built and deployed ready-made AI solutions that insurers can put into production immediately. These accelerators reduce risk, cut implementation time, and deliver measurable ROI from day one.

Underwriting automation

Claims processing automation

Fraud detection & risk control

Customer experience transformation

Deployed conversational AI, 24/7 assistants, and real-time support that improve customer satisfaction while lowering service costs.

Compliance & governance automation

Results & insights from the field

Co-Innovation: The fastest and safest path to AI adoption in insurance

Discover why co-innovation with Firemind, AWS and NVIDIA accelerates AI adoption in insurance. Faster alignment, safer pilots, better outcomes.

Why small, high-Impact AI projects are outperforming Big transformations in insurance

Insurance AI works best when you start small. Explore quick-win workflows, low-risk pilots and funding options to accelerate adoption.

Insurance AI roundtable: Where AI is delivering ROI in insurance

AI is speeding up underwriting, enriching data, and improving decision-making. Key insights from our insurance AI roundtable with AWS and Convex.

Get your guide

New to GenAI in insurance operations?

This guide is designed for senior leaders looking to understand where AI delivers proven value today, how peers are approaching transformation, and what it means for operational excellence across underwriting, claims, and servicing.

Join Firemind, NVIDIA, and AWS for an executive roundtable on how AI is transforming insurance, accelerating discovery and driving advantage.

- 16:00 - 18:00 EET

- Helsinki

Join Firemind, NVIDIA, and AWS for an executive roundtable on how AI is transforming insurance, accelerating discovery and driving advantage.

Get the Guide to Operational Excellence Through AI

Discover how leading insurers use production-ready AI to streamline underwriting, claims, and compliance — and achieve measurable ROI.

Ready to turn AI into impact?

We help you identify high-value opportunities, de-risk your first project, and deliver measurable AI results from day one.

Your benefits:

- Outcome‑driven — measurable business impact

- AWS & NVIDIA recognised — trusted expertise

- Risk‑aware — governance and compliance built‑in

- Faster time to value — Pulse delivers in days

What happens next?

Briefing

A 20-minute focused session.

Rapid AI discovery and validation

Prove value fast.

Asses Readiness.

Accelerate adoption.

Your proposal

Clear plan, budget, and production timeline.

No obligation — just a focused 20-minute discussion about your goals.

FAQs

How long does it take to implement Firemind’s AI solutions for insurance?

How quickly can insurers see results from Firemind’s AI implementation?

How can generative AI improve underwriting and claims processing in insurance?

What are the main AI use cases in the insurance industry today?

What is the best tool for intelligent document processing in insurance?

Our approach combines AI document processing, document workflow automation, and insurance document automation using AWS-native AI frameworks, with optional GPU acceleration via NVIDIA when required for scale or performance. This gives insurers flexibility — enabling automation of claims, underwriting, and policy workflows by extracting and validating data from complex, unstructured documents in seconds.

With hundreds of AI projects delivered across Europe, Firemind’s IDP solutions are proven in production and fully adaptable to each insurer’s infrastructure and governance model. They integrate seamlessly with existing systems to enhance fraud detection, compliance automation, and operational efficiency, helping insurers move beyond pilots to scalable, regulator-ready automation that reduces manual work and accelerates decision-making.